Inflation Uproots Student Cash Flow

June 20, 2023

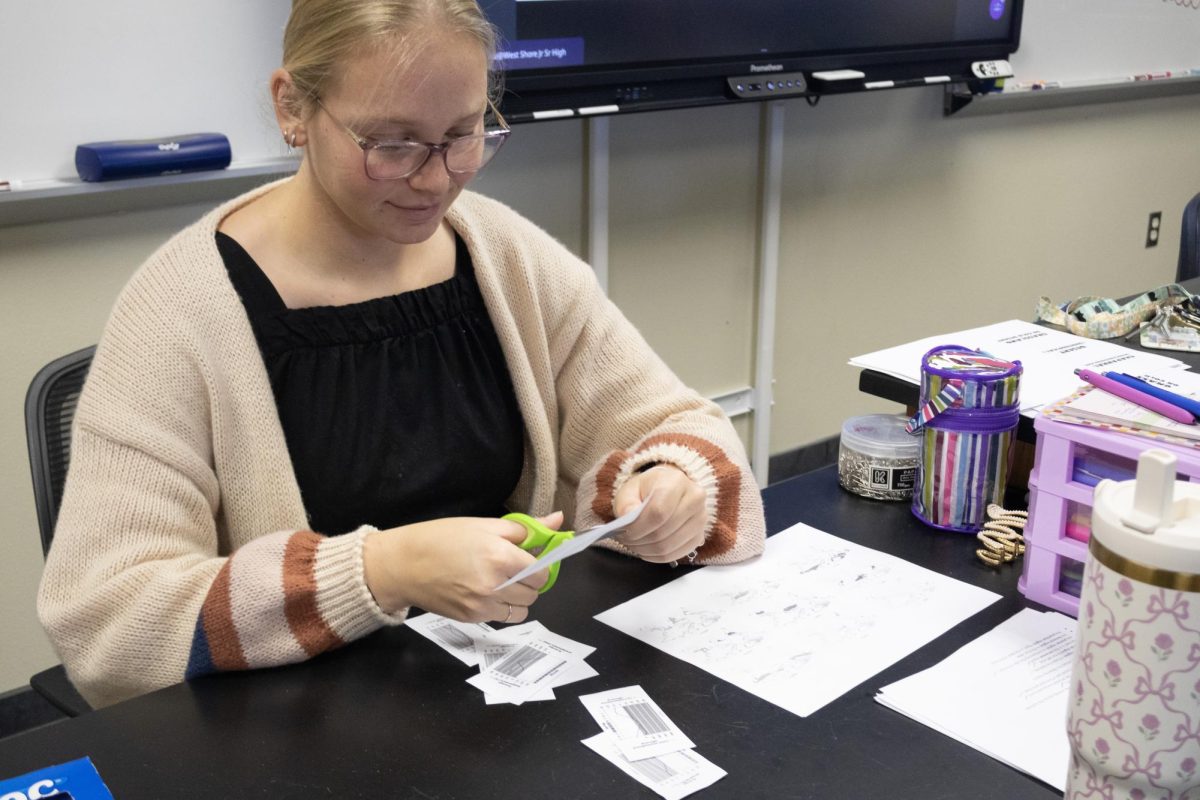

Senior Faith Collins works at the front lines of a fiery economic phenomena, the grocery store. Here she sees the prices of groceries increasing due to steady inflation during the last year, inflation that has made many normal purchases more costly. Gas, groceries, and other products are getting more expensive, leaving Collins worried about her future in college and beyond.

“You hear how college kids all eat ramen to save money,” Collins said. “But at this point ramen is going to be too expensive. So I’m worried about what I’m going to eat and staying healthy in general.”

Ramen is not the only thing inflation has touched recently.

“I have to pay for my lunches at work, and I don’t feel like driving anywhere,” Collins said. “And having to pay for the rising prices while not getting paid more makes it hard to keep working and eating at the same time.”

Freshman Drew Newlin also notes these changes.

“It’s hard since money is becoming less valuable,” Newlin said. “Sometimes I wish money could just grow on trees.”

The cause of recent inflation is complicated, and can at times feel abstract, but can generally be tied to COVID-19. Despite the uncertainty of it, and whether it will continue to be a problem, Junior Rushil Shah, who is the president of Brevard Finance for Youth, said he doesn’t see it persisting.

“Even in the past, there’s been numerous instances where inflation has become really a big issue,” Shah said. “But we’ve always found a way to actually alleviate it and bring the inflation levels back down to normal. So in the long term, there will be a solution, maybe like the Fed taking in a new policy or actions to lower the inflation rates.”

The Fed, or the Federal Reserve System, is a central US bank that controls the money supply and regulates U.S. markets. Alleviating inflation is the Fed’s job, and whether or not they’re successful will impact every corner of the country, including the local grocery store where Collins works.

“At Publix, people will be like ‘I can’t believe these are so expensive,’ or ‘why did you raise the price?’” Collins said. “I just work here so I don’t choose the prices, that’s corporate, and this is happening in all retail right now. People complain to the cashiers and blame them but it’s not our fault. We just get paid to be there.”

Corporations might be raising these prices due to greed, rather than inflation, according to French Economist Albert Edwards. In April, he released a note regarding this, claiming that corporations were using inflation factors, such as the war in Ukraine, as an “excuse” to mark-up prices, and increase profit.

“Inflation is worrying,” Newlin said. “I had to eventually pick up a job because things just started getting too expensive.”

According to FinAid.org, college tuition rates have increases twice as much as general tuition rates. If it were to increase 8 percent each year, college tuition would double every nine years.

“Rising tuition costs definitely scare me, ” Newlin said. “For my parents in particular to afford these tuitions for me and my siblings, wow. My sister too is only 8, thinking about her paying for college, and also my kids in the future. Tuition only ever goes up, so paying it’s never going to get easier.”

![Sophomore Isabelle Gaudry walks through the metal detector, monitored by School Resource Officer Valerie Butler, on Aug. 13. “I think [the students have] been adjusting really well," Butler said. "We've had no issues, no snafus. Everything's been running smoothly, and we've been getting kids to class on time.”](https://westshoreroar.com/wp-content/uploads/2025/08/IMG_9979-1200x800.jpg)